AKRBank Wealth Master Plan

It is uniquely designed to enable people create wealth and ensure that their family's income is protected when they are called home or permanently disable.

How to enjoy this plan

How to enjoy this plan

In creating more wealth to meet your aspirations, you should meet the following requirement:

- Should have a regular stream of income

- A minimum contribution of GHc 50.00 a month to start with

- Should be 18 years and above but not over 60years

- Evidence of health maybe required.

What are the plan benefits?

- There is certainty and peace of mind. You actually know your investment returns at the end of the plan term right from inception.

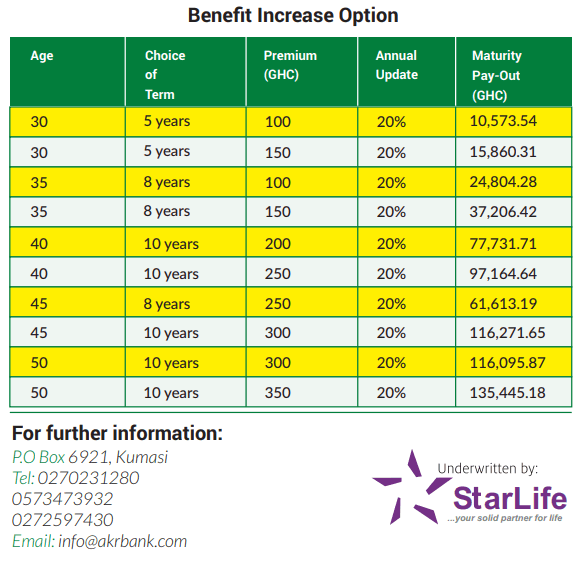

- This amount can be increased substantially through the application of benefit increase option which serve as inflation protector.

- Has attractive life cover same as sum assured.

- A plan loan is accessible after 24 months of contributions

- Adequate financial provision in the event of permanent disability

- Dependent on your goal and ability, you choose a plan suitable for you.

Plan features

- A flexible conventional endowment plan

- Death benefit same as Sum Assured

- A hybrid of attractive life and investment benefit

- Awaiting period of 90 days

- No further contributions in the event of total and permanent disability

Our Services

- Prompt payment of death, total & permanent disability and maturity claims

- Assured of fair, equitable and prompt client service support.